Online consumer loans are quick credit solutions to serve personal financial needs. Below are TOP websites and financial companies personal loan philippines

10+ Web online personal loan philippines lending quick

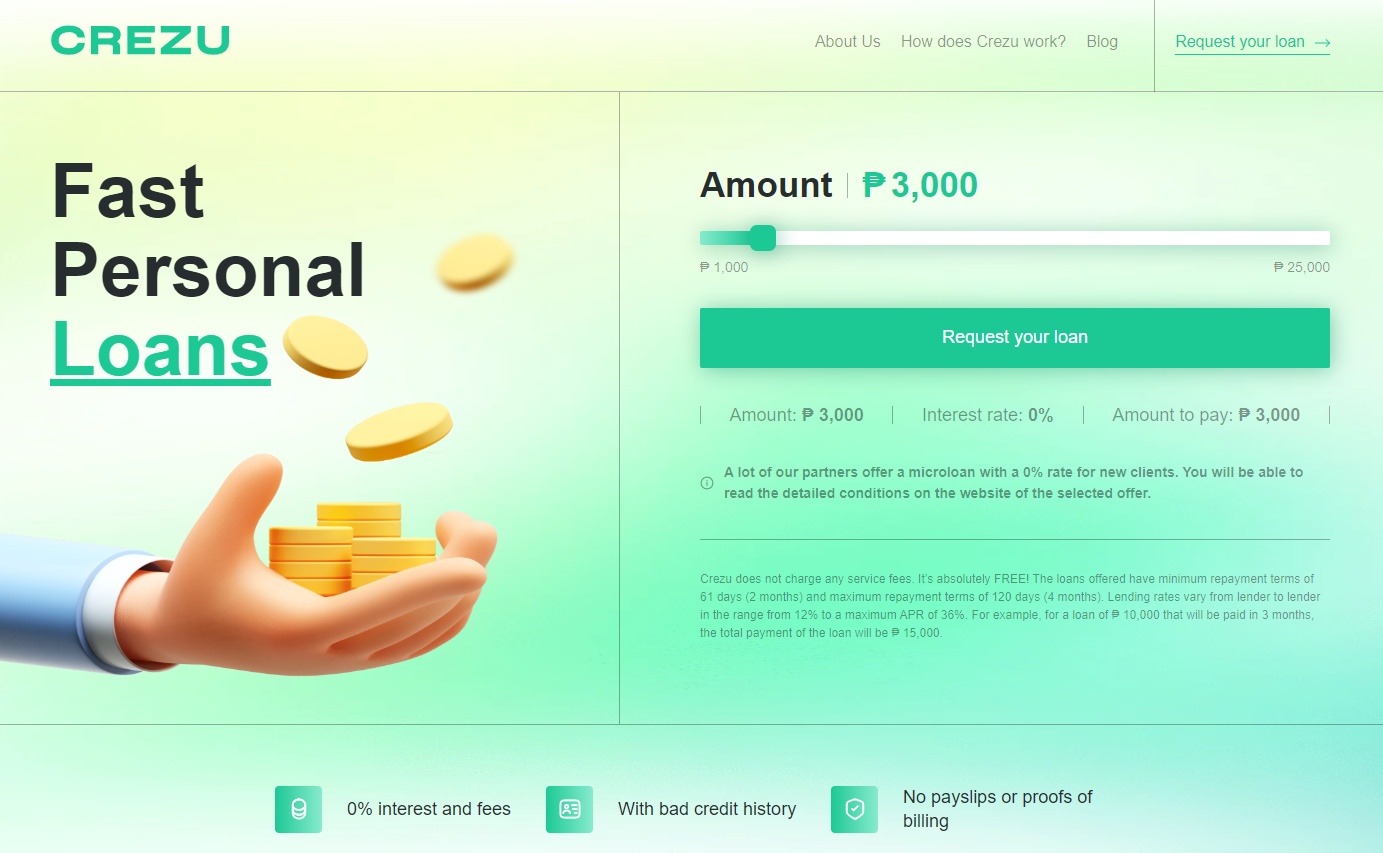

Crezu

Crezu is one of the best quick loan applications on mobile devices today. Crezu is a brand of Fininity Ltd developed as a mobile service to help customers easily search for selected, trustworthy financial institutions to borrow money. Currently, Crezu is collaborating with reputable financial partners in the online loan market such as: OneclickMoney, Cashwagon, Robocash, Tamo and Senmo. Customers can choose one of the above partners to borrow money. Just provide ID card and some basic personal information, customers can borrow up to 10 million VND within 14 minutes.

=> Register for Crezu loan now!

Cashspace

Cashspace is a trademark of the company Fininity Ltd (registration number 14523902, address: Tartu street, 84а, Tallinn, 10112, EE.)

We pool loans for all purposes. 24 hours a day, 7 days a week. Minimum debt payment period 2 months, maximum — 3 months. Maximum annual interest rate (APR) — 3.65%. Interest rates vary depending on the lender, the recommended interest rate will depend on your credit situation and history.

Currently, Cashspace is collaborating with reputable financial partners in the online loan market such as: OneclickMoney, Cashwagon, Robocash, Tamo and Senmo. Customers can choose one of the above partners to borrow money. Just provide ID card and some basic personal information, customers can borrow up to 10 million VND within 14 minutes.

=> Register for Cashspace loan now!

Binixo

Binixo is one of the best quick loan websites on mobile devices today. BInixo was developed as a mobile service that helps customers easily search for selected, trustworthy financial institutions to borrow money. Currently, Binixo is collaborating with reputable financial partners in the online loan market such as: OneclickMoney, Cashwagon, Robocash, Tamo, Senmo… Customers can choose one of the above partners to borrow money. Just provide ID card and some basic personal information, customers can borrow up to 10 million VND within 14 minutes.

=> Register for Binixo loan now!

Digido

Digido is one of the best quick loan websites on mobile devices today. Digido was developed as a mobile service to help customers easily search for selected, trustworthy financial institutions to borrow money. Currently, Digido is collaborating with reputable financial partners in the online loan market such as: OneclickMoney, Cashwagon, Robocash, Tamo, Senmo… Customers can choose one of the above partners to borrow money. Just provide ID card and some basic personal information, customers can borrow up to 10 million VND within 14 minutes.

=> Register for Digido loan now!

Kviku

Kviku is one of the best quick loan websites on mobile devices today. Customers can choose one of the above partners to borrow money. Just provide ID card and some basic personal information, customers can borrow up to 10 million VND within 14 minutes.

=> Register for Kviku loan now!

Finami

Customers can choose one of the above partners to borrow money. Just provide ID card and some basic personal information, customers can borrow up to 10 million VND within 14 minutes.

=> Register for Finami loan now!

Finloo

Finloo is an online service that helps you search and choose consumer finance companies in the Philippines for free. We carefully analyze the market, research conditions and incentives from each lending company to only select lending companies that meet the following criteria:

Best meets your requirements

Trusted company with good reviews

High probability of application approval

=> Register for Finloo loan now!

Finapps

Finapps is an online loan product that gives customers the convenience of quickly accessing loans. This is also a well-known financial unit in the Philippine market and is trusted by customers.

=> Register for Finapps loan now!

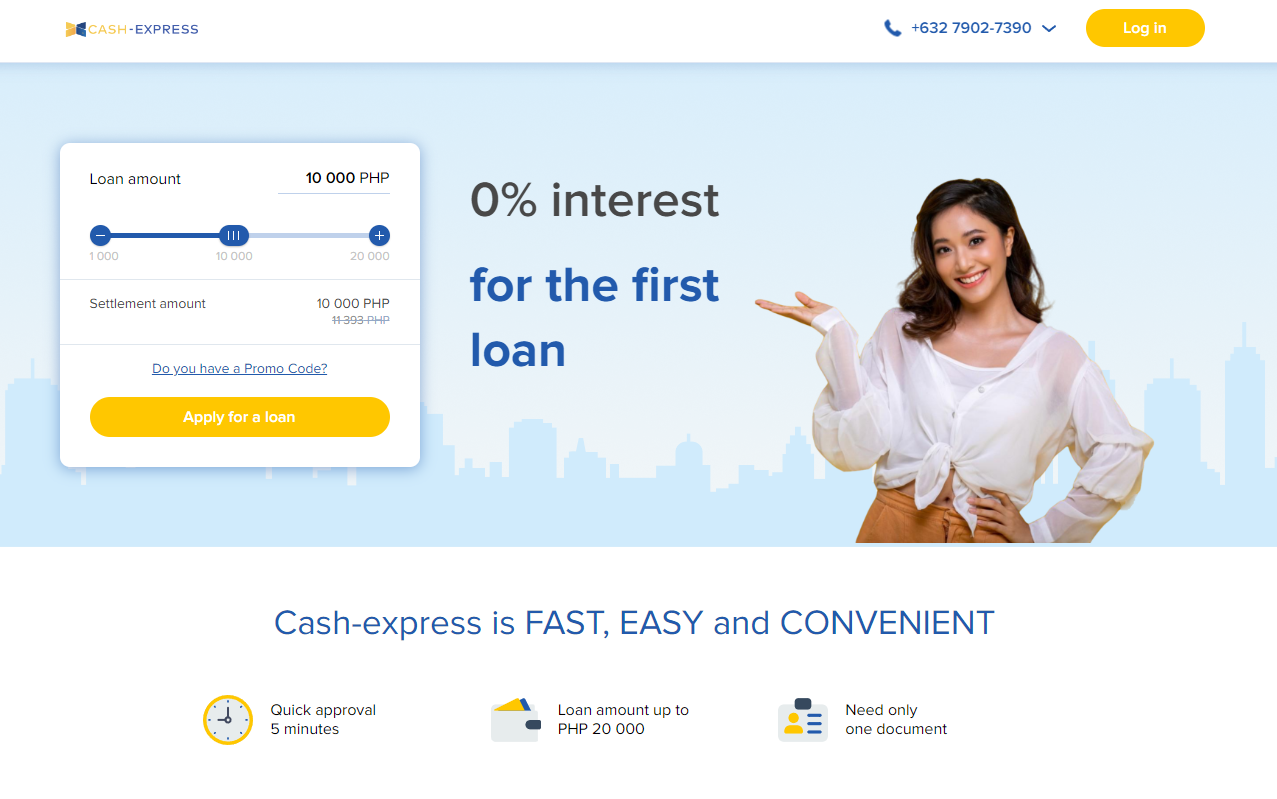

Cashexpress

Cashexpress is a large financial consulting company specializing in online operations. Every day, with our help, customers will quickly solve urgent financial needs in just 24 hours, especially No: handing over documents, queuing, calling multiple times to credit officers, queue and call multiple times to the bank

=> Register for Cashexpress loan now!

Eligibility personal loan philippines

- Individuals aged 21 and above

- Applicant must be no older than 65 upon loan maturity

- Applicant must be a Philippine citizen and a non-US person

- Applicant must have a Philippine mailing address and an active Philippine mobile number

- Applicant must have a minimum gross monthly income of ₱15,000

- Applicant, if employed, must be tenured for at least 6 months, or 1 year of continuous employment, unless employed in the top 15,000 corporations

- Applicant, if self-employed, must be operating for at least 1 year

Online Loans in the Philippines

Irrespective of age, gender, occupation or nationality, people strive hard to achieve financial independence. For many, the conventional teaching of “Spend less, avoid loans, save more” is the gospel words of financial management. The misconception of loans as evil forces makes people avoid loans as far as possible with the fear of getting into debt. Their cold shoulder approach for loans, even under extreme financial stress, can deteriorate the quality of life quite miserably.

But in reality, loans can be your best buddies in improving your financial health in different ways. For instance, a loan to upgrade your work productivity or for securing a new skill will fetch dividends in the long run. For example: A loan for a freelancer to buy a laptop or invest in courses can boost productivity and open doors to better opportunities. It’s an investment that can pay off in the future. But if you take loans to satisfy your shopping addiction or for entertainment, it will damage your financial stability for sure. So it is not loans, but the ways you use them that make the difference.

How do Instant Loans Work in the Philippines?

In the Philippines, the distribution of banks is quite scattered, especially in the non-metro regions. It keeps nearly 70% of the population of the Philippines beyond the ambit of formal banking services. It creates a double whammy effect: the majority of the non-urban population has to travel to remote cities to get banking service. The massive influx of customers makes the banks overcrowded, and you have to spend considerable time in the queue to get things done. Along with the tedious documentation process, it makes loans from banks an unhappy endeavor for the majority.

On the other hand, for most online loans, what you need is just a valid ID card and income proof. The loan application and approval process are straightforward, and anyone with Internet access can get a loan instantly.

The very first step for an online loan is creating a user account on the portal. A user can apply for a loan from their account and upload the necessary documents to prove the creditworthiness. The system will evaluate the application and will give you a decision within a few minutes. Once the loan agreement is approved, you will receive the money in the specified account within half an hour. For repeat borrowers with no pending loans the application and evaluation process for a second loan is simplified.

The Internet penetration of the Philippines is high. So when an urgent financial requirement such as a medical emergency or vehicle repairing hits, any Filipino’s first choice would be an online loan rather than a brick-and-mortar bank in a distant location.